There are four basic types of accounting. These are Single-entry bookkeeping (Cost accounting), Single-entry tax accounting, Financial accounting, and Tax accounting. Each type has a unique purpose. But the following information will give a basic overview. Below, learn more about the different types of accounting. This article will also cover single-entry bookkeeping. This information will help you decide which one is right for you. Learn more about the differences between them and their many benefits.

Cost accounting

There are many differences between traditional and cost accounting. Cost accounting covers all costs that are involved in a company’s production, including variable and fixed. Variable costs vary proportionally to production costs. Fixed costs occur monthly and are not affected with production levels. These costs include the cost of supplies, materials, labor and equipment maintenance. Companies use the results from cost accounting to set budgets, and price their products and services.

This accounting evaluates business costs and how they impact efficiency, profit, operations, and profitability. This information is critical to managers, because it helps them to determine where to cut costs or increase efficiency. Cost accounting is generally not required and does not have to be done according to the same standards as financial accounting. However, cost accounting is still based on the same fundamentals as financial accounting and requires managerial judgement. For example, cost accountants can help a management team determine if a certain decision would hurt the company's bottom line.

Single-entry bookkeeping

Single-entry bookkeeping allows for the recording of financial transactions in a simple and cost-effective way. It does not require any principles, making it an attractive choice for small and medium-sized businesses. This accounting system suits small businesses that do not need to track multiple activities. This system is very affordable and does not require the use of expensive accountants. But single-entry bookkeeping does have its drawbacks.

Single-entry bookskeeping tracks only revenue transactions and expenses. The balance sheet shows assets, liabilities, as well as owner equity. Single-entry bookkeeping records the accounts only once and does not consolidate them. Instead, the bookkeeper records and notes transactions under the beginning balance. He or she then calculates total money at the end.

Accounting for taxes

The main difference in tax accounting from other forms is that the former can be regulated by HMRC, while the latter cannot. Tax accounting is derived from the Internal Revenue Code, and is completely separate from public financial statements. Tax accountants record all transactions that affect a company's taxes, calculate tax owed, as well as fill out necessary forms for HMRC. Individuals may also benefit from the services of tax accountants, since they deal with wealthy individuals that need to minimize their tax liabilities.

Although both accounting types can be used by small businesses, tax accounting is more important because it focuses solely on tax returns. Because tax accounting is regulated by the Internal Revenue Service, businesses and individuals alike need to be aware of the specific rules and regulations for filing and submitting tax returns. However, businesses may need to be more detailed with their expenditures and might benefit from the assistance of a tax advisor.

Financial accounting

Generally, there are 12 different types of financial accounting. Each type has its own purpose and is applied in a specific way. Most accountants focus on one specific area. Some accountants are critical to small-businesses. Accounting is a vital business activity. It involves recording and categorizing transactions. It gives investors a broad view of the company's economic stability. However, financial accounting and management accounting are two different things.

Financial accounting is developed in a social context. There are many factors that affect financial accounting. One of these is the degree of development and inflation in a country. This will often decide the type and style of accounting that is used in the country. The type of accounting that is used can also be affected depending on the social environment. In countries with higher economic development, financial reporting may be given more attention. In many cases, political factors are not as important as financial reporting.

Management accounting

It is a method of financial management that the accountant uses qualitative and quantitative information to improve a business’s operations and financial performance. Managerial accounting is used to set objectives, create plans and make critical decisions for an organization's success. Its main focus is on presenting information in a manner that is useful to managers. Standard costing and budget control are also used to meet the needs for different departments and groups within an organization.

Managerial accounting also helps to assess the business's profitability. Managerial accounting can be used to forecast the revenue and profits and to evaluate the underlying cost of the organization's activities. Managerial accountants examine trends and costs that may impact a company’s ability to make decisions in the future. These financial management techniques include capital budgeting as well as operational budgeting. These techniques can also be used in other types of accounting.

FAQ

What kind of training is necessary to become a bookkeeper?

Basic math skills are required for bookkeepers. These include addition, subtraction and multiplication, divisions, fractions, percentages and simple algebra.

They should also know how to use computers.

Most bookkeepers have a high school diploma. Some have college degrees.

What does it mean for accounts to be reconciled?

A reconciliation is the comparison of two sets. The "source" set is known as the "reconciliation," while the other is the "reconciled".

The source includes actual figures. The reconciled shows the figure that should be used.

For example, if someone owes you $100, but you only receive $50, you would reconcile this by subtracting $50 from $100.

This ensures that there are no accounting errors.

What should I look for in an accountant's hiring decision?

When hiring an accountant, ask questions about their experience, qualifications, and references.

It is important to find someone who has done this before, and who knows what he/she's doing.

Ask them if they have any special skills or knowledge that would be helpful to you.

Look for people who are trustworthy in your community.

What happens to my bank statement if it is not reconciled?

You may not realize you made a mistake until the end of the month if you don't reconcile your bank statements.

At that point, you'll have to go through the entire process again.

How can I get started keeping books?

You will need a few things to begin keeping books. These include a notebook, pencils, calculator, printer, stapler, envelopes, stamps, and a filing cabinet or desk drawer.

What is a Certified Public Accountant?

Certified public accountant (C.P.A.). is a person with specialized knowledge in accounting. He/she knows how to prepare tax returns and assist businesses in making sound business decisions.

He/She also monitors the cash flow of the company and ensures that it runs smoothly.

Accounting is useful for small business owners.

Accounting is not only for large businesses. It's also useful for small business owners because it helps them keep track of all the money they make and spend.

If you run a small business, you likely know how much money comes in each month. But what if your accountant doesn't do this for a monthly basis? It's possible to be confused about where your money is going. You could also forget to pay bills on-time, which could impact your credit score.

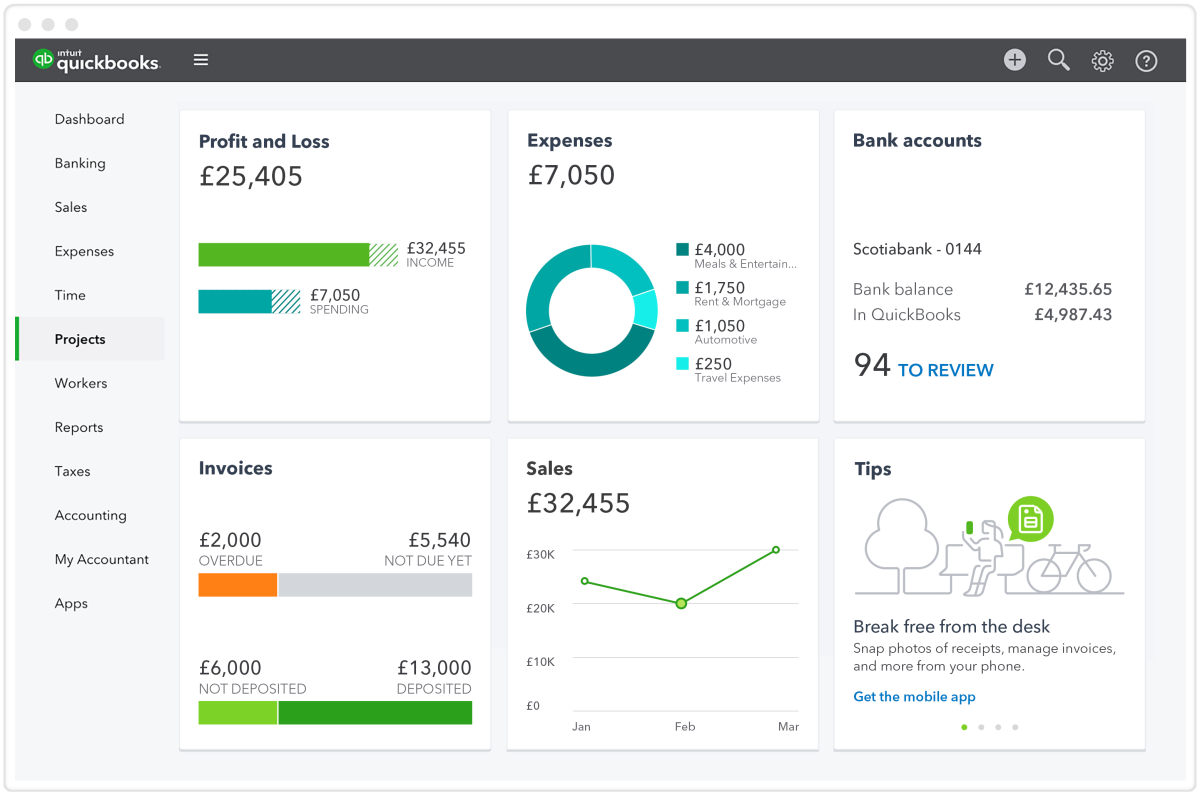

Accounting software makes it easy for you to keep track and manage your finances. And there are many different kinds available. Some are free; others cost hundreds or thousands of dollars.

However, regardless of the type of accounting software you choose, you will need to be familiar with its basics. It will save you time and help you understand how to use it.

These are the basics of what you should do:

-

Transcript transactions to the accounting system

-

Keep track of your income and expenses.

-

Prepare reports.

Once you've mastered these three things, you're ready to start using your new accounting system.

Statistics

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

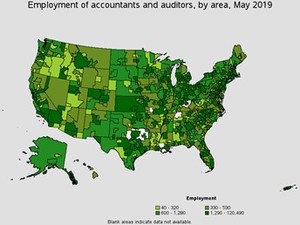

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

External Links

How To

How to Get an Accounting Degree

Accounting is the act of recording financial transactions. It includes recording transactions made by businesses, individuals, and governments. A bookkeeping record is called an "account". These data are used by accountants to create reports that help companies or organizations make decisions.

There are two types, general (or corporate), accounting and managerial accounting. General accounting is concerned with the measurement and reporting of business performance. Management accounting focuses on measuring, analyzing, and managing the resources of organizations.

A bachelor's degree in accounting prepares students to work as entry-level accountants. Graduates may also choose to specialize in areas like auditing, taxation, finance, management, etc.

If you are interested in a career as an accountant, you will need to have a basic understanding of economic concepts, such as supply, demand, cost-benefit analysis. Marginal Utility Theory, consumer behavior. Price elasticity of demande and the law of one. They must also understand microeconomics, macroeconomics, international trade, accounting principles, and various accounting software packages.

A Master's degree in Accounting requires that students have successfully completed six semesters worth of college courses. These include Microeconomic Theory, Macroeconomic Theory. International Trade. Business Economics. Financial Management. Auditing Principles & Procedures. Accounting Information Systems. Cost Analysis. Taxation. Human Resource Management. Finance & Banking. Statistics. Mathematics. Computer Applications. English Language Skills. Graduate Level Examinations are required for all students. This exam is typically taken at the end of three years' worth of study.

Candidats must complete four years' worth of undergraduate study and four years' worth of postgraduate work in order to be certified public accountants. Candidates must then take additional exams before they can apply for registration.