This article will examine the hourly pay and average salary of bookkeepers. Also, you will learn about the education required and the outlook for your career. You will learn more about the career options for bookkeepers and how to get started. You have many options for advancement so make sure to look into your options.

Bookkeepers earn an average annual salary

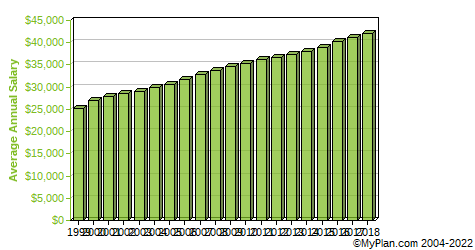

According to Bureau of Labor Statistics, the annual average salary of a bookkeeper is around $51,000. This figure includes the base salary, bonuses and tips. However, this figure can differ widely depending on the education, experience and skill set of the employee. It also varies depending on where you are located.

The average salary of a bookkeeper can be considerably higher than the average salary of other professionals. This profession is flexible, so those with higher educational qualifications or experience will be able command higher salaries.

Hourly rate

While it's common to charge hourly rates for bookkeeping services, this is not the best practice for all bookkeepers. This method takes a lot of time on the part the bookkeeper and can frustrate clients if they don't pay on-time. You also have options for bookkeepers: flat rates or blended rate.

The financial transactions of individuals as well as companies are recorded by bookkeepers. They create and maintain budgets and financial forecasts. As such, bookkeepers earn high wages. It's therefore important to know the average hourly wage for bookkeeping services across the United States.

Education is required

While many bookkeepers hold a bachelor's or associate's degree, many employers only require high school diplomas. A high school diploma will provide you with basic math skills and writing skills that will allow you to do your job well. It will teach you valuable time management and teamwork skills. This is vital to succeed in a competitive job marketplace.

There are several organizations that certify bookkeepers. Although this occupation does not require licensure, employers frequently seek certification as evidence of competence. The American Institute of Professional Bookkeepers (AIPB), for example, offers the Certified Bookkeeper credential. Those who earn certification through AIPB must complete two years of full-time bookkeeping experience and pass a four-part examination. Certification is a great way prove your competence and to improve your job opportunities.

Outlook for the Job

The outlook for bookkeepers looks good, especially when you consider the number of opportunities available for new entrants to this field. New entrants to the field should be given plenty of opportunities as older bookkeepers retire. Fortunately, the projected decline in overall employment should not negatively affect this profession. It is also a lucrative career that pays well, with a high average salary and low unemployment.

A bookkeeper has the choice to work freelance, open a new business or continue working in an existing company. Bookkeepers have a bright future and great prospects for advancement and income. The job is highly technologically-driven, making it a great option for those seeking a career remotely.

FAQ

What is an auditor?

An audit is a review or examination of financial statements. An auditor examines the company's accounts to ensure that everything is correct.

Auditors search for discrepancies between the reported events and the actual ones.

They also make sure that the financial statements are correctly prepared.

What is reconciliation?

This is important as you never know when errors might occur. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can have grave consequences, including incorrect financial statements or missed deadlines, overspending and bankruptcy.

What is the average time it takes to become an accountant

Passing the CPA test is essential in order to become an accounting professional. Most people who wish to become accountants study for around 4 years before taking the exam.

After passing the test one must have worked for at minimum 3 years as an Associate before becoming a Certified Public Accountant (CPA).

How do accountants function?

Accountants work closely with their clients to make sure they get the most from their money.

They work closely alongside professionals like bankers, attorneys, auditors and appraisers.

They also work with internal departments like human resources, marketing, and sales.

Accountants are responsible in ensuring that books are balanced.

They determine how much tax must be paid, and then collect it.

They prepare financial statements that show the company's financial performance.

Statistics

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to Get a Degree in Accounting

Accounting is the art of keeping track and recording financial transactions. It includes recording transactions made by businesses, individuals, and governments. Accounting refers to bookkeeping records. To help businesses and organizations make informed decisions, accountants prepare reports using these data.

There are two types of accountancy - general (or corporate) accounting and managerial accounting. General accounting is concerned with the measurement and reporting of business performance. Management accounting focuses primarily on the measurement, analysis, and management of resources.

A bachelor's in accounting can prepare students to work as entry-level accountants. Graduates can also opt to specialize in areas such as auditing, taxation or finance management.

If you are interested in a career as an accountant, you will need to have a basic understanding of economic concepts, such as supply, demand, cost-benefit analysis. Marginal Utility Theory, consumer behavior. Price elasticity of demande and the law of one. They should be able to comprehend macroeconomics, microeconomics as well as accounting principles.

A Master's Degree in Accounting is only available to students who have completed at least six semesters in college courses in Microeconomic Theory, Macroeconomic Theory, International Trade; Business Economics; Finance Principles & Procedures. Cost Analysis; Taxation; Human Resource Management; Finance & Banking. Statistics; Mathematics; Computer Applications. English Language Skills. Students must also pass a Graduate Level Examination. This examination is usually taken following three years of studies.

To become certified public accountants, candidates must complete four years of undergraduate studies and four years of postgraduate studies. Before they can apply for registration, candidates will need to take additional exams.