There are many reasons you might need the services of an accounting professional. Hiring an accountant is a great way to benefit your business, especially if you are a small-business owner. Here are just a few of them. In today's changing financial environment, these professionals are essential. Lenders will require that you prove you can pay back the money you borrowed. Professional accountants are able to provide the numbers you require to support your loan application. You can also rely on them to manage your finances, keep you up-to-date with tax laws, as well as complete compliance documents for the business.

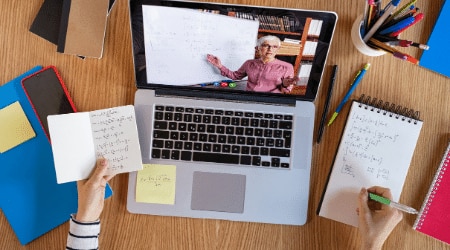

Small business owners can benefit from the services of an accountant.

Although only 60% of small-business owners are familiar with accounting basics, it is still a smart idea to hire an accountant. Hiring an accountant means you'll get the best service and save the most money. An accountant can also help you determine your tax liability and file your tax return well before the due date. This broad perspective is critical for continued business growth. The accountant will also keep your books in order.

An accountant can handle your pension and payroll tasks. They will ensure your employees receive the correct wages and make the proper deductions from their paychecks. Payroll tasks can be difficult to handle yourself. Sometimes, you might owe too much tax to your employees or take too long to get paid. This stress can be relieved by hiring an accountant to handle payroll.

Investing in an accountant

It is essential to hire an accountant if you own a small business. Basic accounting knowledge will only take you so far. Complex books can lead to serious mistakes. You need a professional to manage your books. This includes payroll and tax issues. Highwoods & Associates are one such firm that offers first-class advice on accounting services. In addition to offering a full range of accounting services, they can help with business start-ups and tax preparation.

Your accountant can help you manage your cash flow. This includes all activities of your company and any financial investments. You need adequate cash flow to stay in business, and if you don't have enough of it, you can quickly fall into financial trouble. An accountant will help maintain cash management policies and manage your credit. This will allow you to make better business decisions and lower your chance of getting into trouble. A good accountant will also help you keep track of your expenses, so you can make better business decisions.

The benefits of employing an accountant

An accountant's expertise can help you manage your business' finances. Many business decisions involve finances, such as hiring new employees or launching a new product. They can also make accurate projections that will help you decide the best course. Your industry's trends can also be analyzed by accountants. Your accountant can help you create a business plan for your company and devise strategies to maximize profits as your business grows.

You may feel tempted to do all your accounting yourself. Although doing your tax returns and books yourself can save money, an accountant will be able to provide the expertise you need to maximize your profit. An accountant is available to answer any questions about your business. They can help you identify business tax concessions, which can improve your bottom line. Your accountant can help you make sound financial and business decisions. This can free up your time to focus on other aspects of your business.

FAQ

What kind of training does it take to be a bookkeeper

Basic math skills such as addition and subtraction, multiplication or division, fractions/percentages, simple algebra, and multiplication are essential for bookkeepers.

They also need to know how to use a computer.

The majority of bookkeepers have a high-school diploma. Some even have college degrees.

What does an auditor do?

Auditors look for inconsistencies between financial statements and actual events.

He validates the accuracy of figures provided by companies.

He also confirms the accuracy of the financial statements.

What does it entail to reconcile accounts?

A reconciliation is the comparison of two sets. One set of numbers is called the source, and the other is called reconciled.

Source consists of actual figures. The reconciled is the figure that should have been used.

You could, for example, subtract $50 from $100 if you owe $100 to someone.

This ensures there are no errors in the accounting system.

What is an Audit?

An audit is a review or examination of financial statements. To ensure everything is correct, an auditor reviews the company's financial statements.

Auditors look for discrepancies between what was reported and what actually happened.

They also make sure that the financial statements are correctly prepared.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to become an accountant

Accountancy is the science of recording transactions and analyzing financial data. It involves the preparation and maintenance of various reports and statements.

A Certified Public Accountant or CPA is someone who has passed an exam and received a license from the state board.

An Accredited Financial Analyst (AFA) is an individual who meets certain requirements set forth by the American Association of Individual Investors (AAII). A minimum of five years investment experience is required to become an AFA by the AAII. A series of exams is required to assess their knowledge of securities analysis and accounting principles.

A Chartered Professional Accountant (CPA), sometimes referred to as a chartered accountant, is a professional accountant who has been awarded a degree from a recognized university. CPAs must adhere to the Institute of Chartered Accountants of England & Wales' (ICAEW), specific educational requirements.

A Certified Management Accountant, also known as a CMA, is a certified professional who specializes on management accounting. CMAs have to pass exams administered by ICAEW and keep up-to-date with continuing education requirements throughout the course of their careers.

A Certified General Accountant (CGA), member of the American Institute of Certified Public Accountants. CGAs have to pass several tests. One test is known as the Uniform Certification Examination.

The International Society of Cost Estimators offers the certification of Certified Information Systems Auditor (CIA). Candidates for the CIA must have completed three levels of education: coursework, practical training, then a final exam.

Accredited Corporate Compliance Office (ACCO), a designation conferred by the ACCO Foundation as well as the International Organization of Securities Commissions. ACOs must possess a Bachelor's Degree in Finance, Business Administration, Economics, or Public Policy. They must pass two written exams, and one oral exam.

The National Association of State Boards of Accountancy offers the certification of Certified Fraud Examiners (CFE). Candidates must pass at least three exams to be certified fraud examiners (CFE).

International Federation of Accountants is accredited a Certified Internal Audior (CIA). The International Federation of Accountants (IFAC) requires that candidates pass four exams. These include topics such as auditing and risk assessment, fraud prevention or ethics, as well as compliance.

American Academy of Forensic Sciences' (AAFS), designates Associate in Forensic Analysis (AFE). AFEs must be graduates of an accredited college or university that has a bachelor's in accounting.

What is an auditor? Auditors are professionals who conduct audits of organizations' internal controls over financial reporting. Audits can be performed on either a random basis or based on complaints received by regulators about the organization's financial statements.