There are many types and styles of financial analysis. You can choose from Ratio and Scenario analysis as well as Vertical and Historical trend analysis. Each analysis has its advantages and disadvantages. Find out more about the different types of analysis, and how they impact a company’s finances. Learn more about each type of analysis and the importance to the tools and techniques you use. How do you decide which type to use? We'll be discussing some of the most popular types of financial analysis in this article.

Ratio analysis

Financial ratio analysis can prove to be very useful in a variety of contexts. This includes industry comparisons and evaluating the company's profitability. Investors will not be unfairly influenced by financial ratio analysis. Companies must separate their data into divisions. To measure its performance relative its peers, industry peers and competitors within the same industry, a company will typically use ratio analysis. However, some companies "fudge" numbers to make the results seem better than it really is.

Ratio analysis is a great tool for determining profitability. This measure helps businesses determine their overall profitability and efficiency. This measure can help identify areas that are underutilized or overextended. External and internal analysts will be able to determine the areas where they can improve their financial performance. Moreover, these analyses can help identify trends and help make informed decisions.

Scenario and sensitivity analysis

Two types are available to financial analysts: sensitivity analysis and scenario analysis. Scenario and sensitivity analysis identify how variables affect a business's financial condition. Scenario analysis is focused on a particular scenario, while sensitivity analysis looks at a variety of possible outcomes. Sensitivity analysis helps investors understand how different changes could affect their business's profitability. Both of these techniques are valuable for different reasons. Below are examples of both types of financial analysis.

Financial models are often equipped with worksheets for scenario and sensitivity analysis. However, these two types of analysis should not be confused. Scenario analysis, a type of financial modeling that predicts what might happen in different scenarios, is called "Downside Scenario". A scenario could be called "Downside Scenario" if one variable reduces the company's revenue 10%. Sensitivity analysis, on the other hand, will only focus on a percentage decrease. Financial analysts can assist companies in making more informed decisions by using both types.

Vertical analysis

Vertical analysis of financial statements requires the company's balancesheet. A balance sheet displays all the assets, liabilities and equity of a company. As a comparison, the total assets, liabilities, equity are used. While assets are generally current, liabilities are mostly fixed. Comparing the two sets of financial statements can help you identify trends and spot potential problems. Vertical analysis is an excellent choice for many people.

While this type of analysis is not recommended for all businesses, it is a great way to compare and understand the profitability of different companies. It's especially useful to identify areas that are going through significant financial changes, such the cost of sales. This analysis requires you to compile financial statements for all companies and then compare them. The information you gather can be used to develop recommendations for the success of the company.

Historical trend analysis

An historical trend analysis is useful for business owners. Financial trends reveal that profitability is rising in tandem to revenue. The year 2018 saw a greater net income because of lower taxes. This tool allows you to measure the impact on key business decisions such as lowering expenses or raising prices. A historical trend analysis allows businesses to see how they compare to other companies. It is an invaluable tool for tracking and assessing business performance.

This analysis is particularly useful for financial data that spans many years. It is used for analyzing trends and inaccuracies in financial reports, as well to assess overall growth and changes. This analysis can help you identify the factors that are driving these trends. This type can be very helpful in the financial realm and is crucial for making data-driven business decisions. If you're an investor or a business owner, it's vital to understand the principles of financial trend analysis and how it applies to your industry.

FAQ

How does an accountant do their job?

Accountants partner with clients to help them get the most out their money.

They work closely with professionals such as lawyers, bankers, auditors, and appraisers.

They also interact with departments within the company, such as sales and marketing.

Accounting professionals are responsible for maintaining balance in the books.

They calculate the amount to be paid and collect it.

They also prepare financial reports that reflect how the company is doing financially.

How long does it usually take to become a certified accountant?

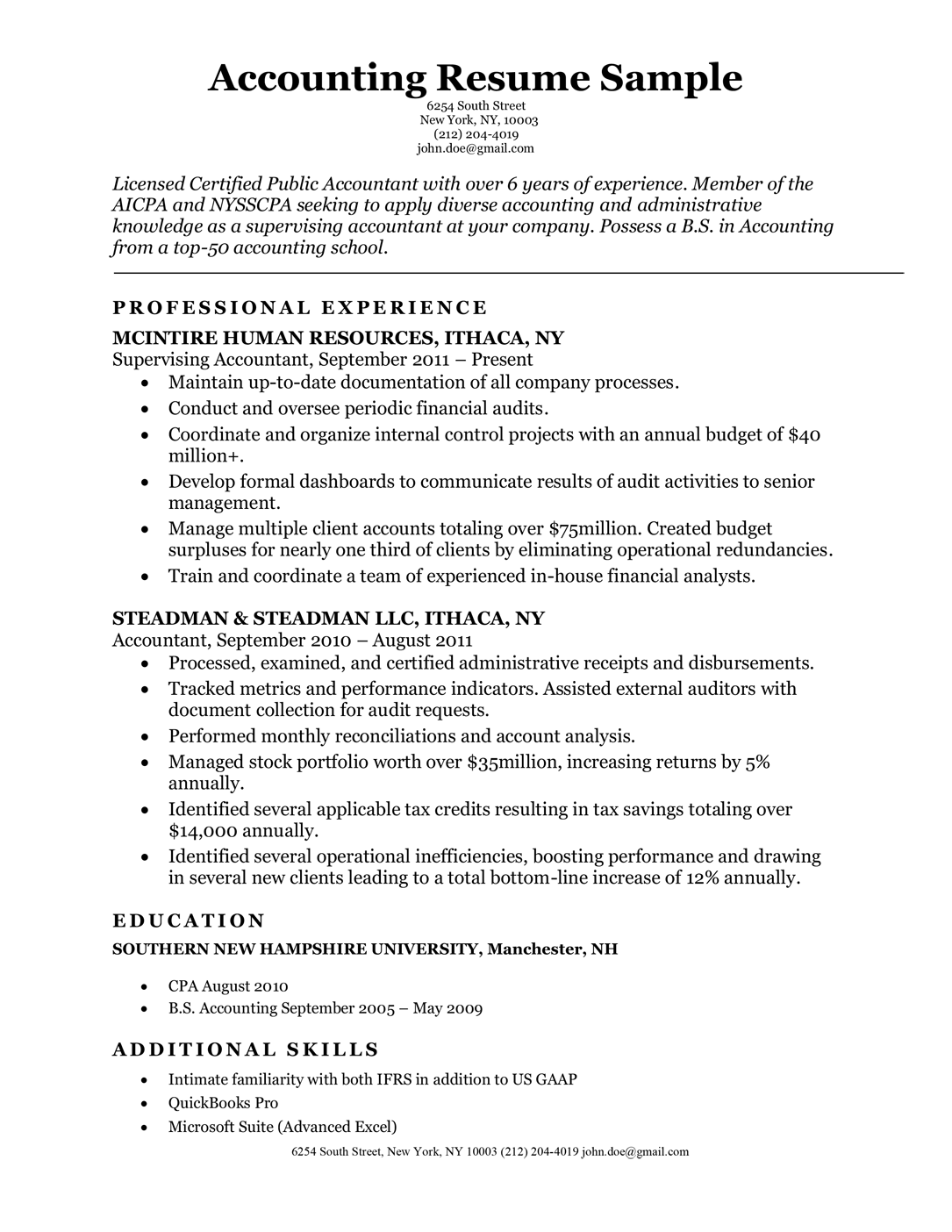

To become an accountant, one needs to pass the CPA exam. The average person who wants to become an accountant studies for approximately 4 years before sitting for the exam.

After passing the exam, one must be an associate for at most 3 years in order to become a certified public accounting (CPA) after passing it.

What is the difference between a CPA (Chartered Accountant) and a CPA (Chartered Accountant)?

Chartered accountants are accountants who have passed all the necessary exams to get the designation. Chartered accountants have more experience than CPAs.

A chartered accountant also holds himself out as being able to give advice regarding tax matters.

The course of chartered accountantancy takes approximately 6 years.

Why is reconciliation important

This is important as you never know when errors might occur. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can lead to serious consequences like inaccurate financial statements and missed deadlines, excessive spending, bankruptcy, and other negative effects.

What kind of training does it take to be a bookkeeper

Bookkeepers must have basic math skills such as addition, subtract, multiplication and division, fractions or percentages, and simple algebra.

They should also know how to use computers.

A majority of bookkeepers hold a high school diploma. Some even have college degrees.

Statistics

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

External Links

How To

How to get an accounting degree

Accounting is the process of keeping track of financial transactions. It records transactions made by individuals, governments, and businesses. Accounting refers to bookkeeping records. These data are used by accountants to create reports that help companies or organizations make decisions.

There are two types accounting: managerial and general accounting. General accounting deals with reporting and measuring business performance. Management accounting focuses on measuring, analyzing, and managing the resources of organizations.

An accounting bachelor's degree can help students become entry-level accountants. Graduates can also opt to specialize in areas such as auditing, taxation or finance management.

For students interested in pursuing a career of accounting, they should be able to understand basic economic concepts such as supply/demand, cost-benefit analysis (MBT), marginal utility theory, consumer behavior and price elasticity of demand. They need to know about accounting principles, international trade, microeconomics, macroeconomics and the various accounting software programs.

A Master's degree is available for students who have completed at most six semesters of college courses. Graduate Level Examination is also required. This examination is usually taken following three years of studies.

Four years of undergraduate education and four years postgraduate study are required to become certified public accountants. After passing the exams, candidates can apply to register.