It is necessary to receive the correct training if you wish to pursue a career in bookkeeping. There are two types of courses available: formal and self-directed learning. A certificate program at your local community college or career center will equip you with the necessary skills to be successful in entry-level positions. Employers may also offer internships to help bookkeepers learn on the job. If you don't have any practical experience, you can compensate for this by showing employers that you're a hard worker with room for growth.

Bookkeepers also need to be trained and know how to use accounting software. They should be familiar with Microsoft Excel. These skills will allow your bookkeeper to manage the company's finances. Consider adding additional benefits to your company in order to attract top talent. To attract top talent, consider offering childcare reimbursements or sponsorships at conferences. Make sure to include a call for action for prospective bookkeepers. A good call to action will convert potential applicants into actual applicants.

While most bookkeepers don't sign a code of ethics, you should have a set of rules and procedures that you want your accountant to follow. It doesn’t matter if your accountant follows GAAP guidelines. But it’s vital that you feel comfortable working alongside them. No matter the training you're receiving, you will have to comply with company policies. The top three bookkeeping rules are listed below.

Education is also a requirement. Bookkeepers must have a high level of business acumen. While you don't necessarily need a college education, it is beneficial to receive formal training in finance and business accounting. Additionally, you should be prepared for interviews. It is essential to stay up-to date with accounting rules and regulations. You can earn your first-level job with a bachelor's degree.

It is important to also obtain certification. The CPB certification in the United States is administered by the National Association of Certified Public Bookkeepers. Qualified bookkeepers have the option to obtain a similar credential, which is called certified bookkeeper (CB), through the American Institute of Professional Bookkeepers. Both AIPB and the National Association of Certified Public Bookkeepers offer preparation courses for their certification exams. You can also find study guides and books online for independent study.

Bookkeeping can be a time-consuming task for business owners. Sometimes, they're pivoting their business and need more financial information. This information can be prepared by a professional bookkeeper to help ensure that the business continues to grow financially. For this purpose, they need to incur business expenditure. If you have more money than time to devote to this task you can outsource it to a bookskeeper. These are great benefits. As time goes on, your bookkeeping skills will improve.

Nonprofit organizations require accountants with a CPA designation. These accountants often have a minimum of a four year college education and are likely to seek certifications. A nonprofit bookkeeper is skilled in data entry, analysis, and reporting. You should look for someone who has experience in this field and is able to recommend the best bookkeepers. An outside bookkeeper can provide invaluable insight into your nonprofit's growth.

FAQ

What are the benefits of accounting and bookkeeping?

Accounting and bookkeeping are essential for every business. They can help you keep track if all your transactions are recorded and what expenses were incurred.

They can also help you avoid spending too much on unnecessary things.

You need to know how much profit you've made from each sale. It's also necessary to know your responsibilities to others.

You can raise your prices if you don’t have enough cash coming in. If you raise them too high, though, you might lose customers.

You may be able to sell some inventory if you have more than what you need.

If you have less than you need, you could cut back on certain services or products.

All these factors can impact your bottom line.

What is the distinction between a CPA & Chartered Accountant, and how can you tell?

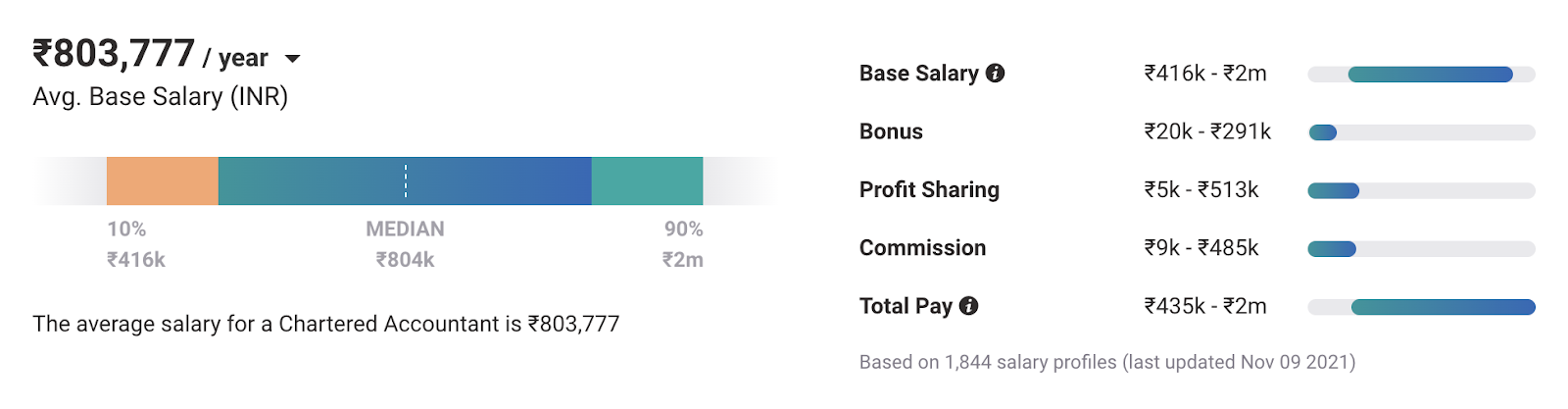

Chartered accountants are accountants who have passed all the necessary exams to get the designation. A chartered accountant is usually more experienced than a CPA.

Chartered accountants also have the ability to provide tax advice.

The average time to complete a chartered accountancy program is 6-8 years.

What is accounting's purpose?

Accounting provides a view of financial performance by measuring and recording transactions, analyzing them, and reporting on them. Accounting allows organizations make informed decisions about how much money to invest, how likely they are to earn from their operations, and whether or not they need to raise additional capital.

To provide information on financial activities, accountants record transactions.

The organization can use the collected data to plan its future strategy and budget.

It is important that the data you provide be accurate and reliable.

What is an audit?

An audit is an examination of the financial statements of a company. To ensure everything is correct, an auditor reviews the company's financial statements.

Auditors search for discrepancies between the reported events and the actual ones.

They also check whether the company's financial statements are prepared correctly.

What type of training is required to become a Bookkeeper?

Bookkeepers must have basic math skills such as addition, subtract, multiplication and division, fractions or percentages, and simple algebra.

They will also need to be able use a computer.

Many bookkeepers have a highschool diploma. Some have even earned college degrees.

What does reconcile account mean?

A reconciliation is the comparison of two sets. One set is called the "source," and the other is called the "reconciled."

The source consists of actual figures, while the reconciled represents the figure that should be used.

If someone owes $100 but you receive only $50, this would be reconciled by subtracting $50 from $100.

This ensures that there are no accounting errors.

How do I know if my company requires an accountant?

Many companies hire accountants when they reach certain size levels. If a company has $10 million annual sales or more, it will need one.

Many companies employ accountants regardless of size. These include sole proprietorships, partnerships and corporations.

A company's size does not matter. Only what matters is whether or not the company uses accounting software.

If it does, then the company needs an accountant. It doesn't if it doesn't.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

External Links

How To

How to do bookkeeping

There are many options for accounting software today. There are many types of accounting software available today. Some are free while others cost money. However, they all offer basic features like invoicing and billing, inventory management as well as payroll processing, point of sale systems and financial reporting. Below is a short description of some common accounting packages.

Free Accounting Software: This software is typically free for personal use. It may have limited functionality (for example, you cannot create your own reports), but it is often very easy to learn how to use. A lot of free programs can be used to download data directly to spreadsheets. This makes them very useful for anyone who wants to do their own analysis.

Paid Accounting Software is for businesses with multiple employees. These accounts provide powerful tools for managing employee records and tracking sales and expenses. They also allow you to generate reports and automate processes. While most paid programs require a subscription fee for at least one-year, many companies offer subscriptions that last just six months.

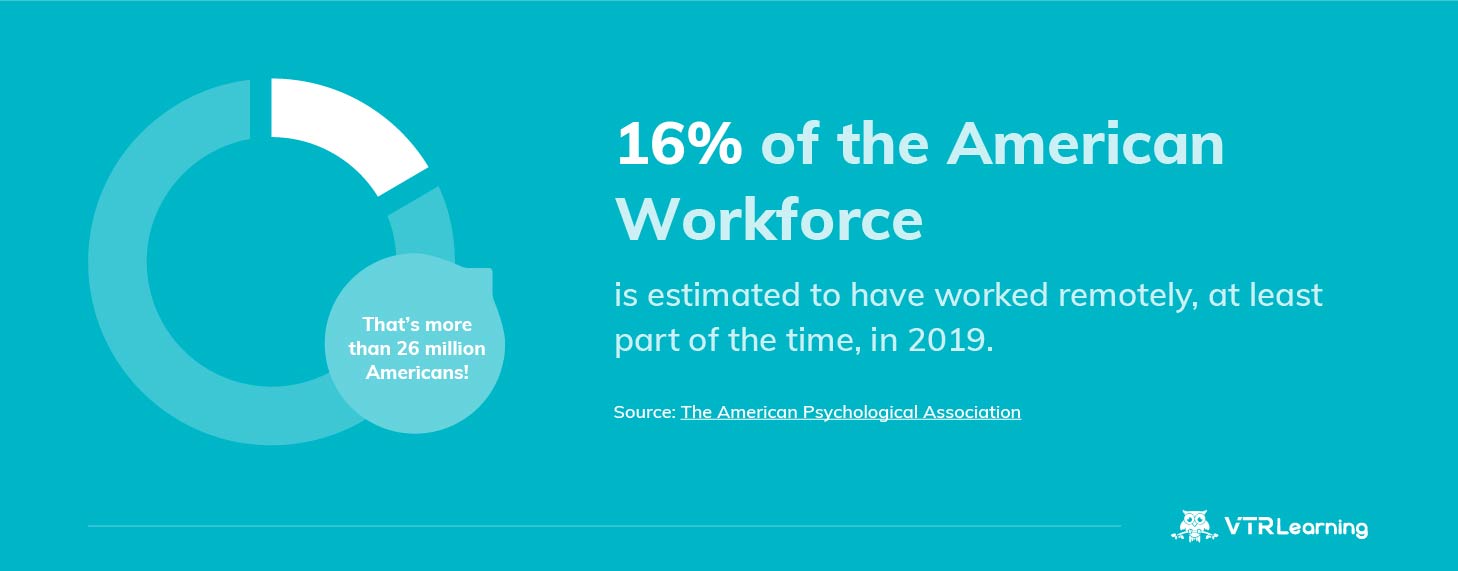

Cloud Accounting Software: You can access your files from anywhere online using cloud accounting software. This program is becoming increasingly popular due to its ability to save space on your computer hard drives, reduce clutter, and make remote work easier. You don't even have to install any extra software. All you need to access cloud storage is an Internet connection.

Desktop Accounting Software - Desktop accounting software runs locally on the computer. Desktop software works in the same way as cloud software. It allows you to access files from any location, including via mobile devices. The only difference is that you will have to install the software first before you can access it.

Mobile Accounting Software - Mobile accounting software is specially designed for small devices such as smartphones and tablets. These programs enable you to manage your finances even while you're on the move. They offer fewer functions than desktop programs, but are still useful for those who travel a lot or run errands.

Online Accounting Software: This online accounting software is intended primarily for small business. It provides all of the same features as a traditional desktop program but adds a few extras. One advantage of online software is that it requires no installation; simply log onto the site and start using the program. You'll also save money by not having to pay for local office costs.