If you're considering a career in accounting, there are several options to choose from. There are several options. You could work for a large firm, one or more of the "Big Four" accountants, or start your own firm. Here are some of the benefits and cons for each option. Which one would suit you best? And how will it affect your salary? Which path will lead you to a higher salary? Which experience are you required to succeed?

You can only work for one company

Working for one organization may not be the best choice if you are looking to make a career as an accountant. An average stay at an entry-level post is one to five years. This will depend on the organization, the economy, and any opportunities that exist elsewhere. In this article, we'll assume that you will stay at the same organization for one year. You will ultimately decide which work environment is right for you.

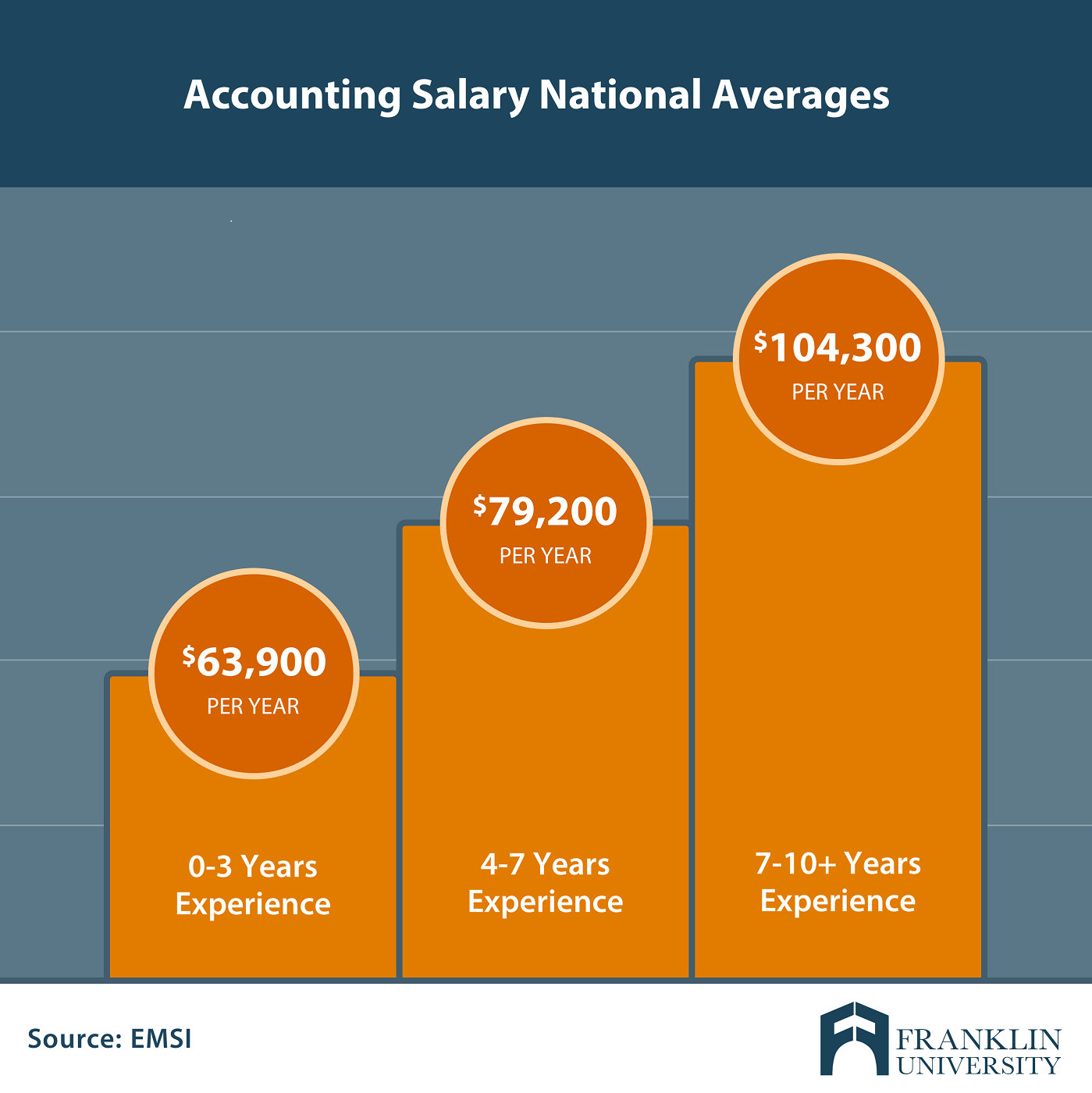

Earning a high salary

Accounting may be the right career for you if you enjoy math. Accounting professionals earn a median annual salary of $92,246, making it a highly desirable career choice. You'll be the head or department's accounting manager and oversee all aspects regarding a company’s finances. These include financial statements as well as general ledger, payroll and accounts payable and dues. You will also be responsible for tax compliance and budgeting.

Many accountants work as partners or CFOs in large companies. Some work as independent consultants, helping clients with their tax returns. With high salaries in accounting jobs, it is possible to work from your home. It just requires a bit of creativity and determination. It doesn't take much to get a job as an accountant, but you will find one that pays well.

Working in an "Big Four” accounting firm

Many people want to work for one of four Big Four accounting firms. What are the advantages and drawbacks to this position? There are many reasons to consider a Big Four accounting firm if you are looking for an entry-level position in the field of accounting. These are the pros and cons to working for a Big Four company over a regional one. This will help you decide if this is the right job for you.

You must demonstrate the qualities that make a great employee for a Big Four business when you apply to one. You must be confident and determined to work for the company and its clients. You should also be able to demonstrate your commitment to a company's vision, be commercially savvy, and exhibit emotional intelligence. Additional to these skills, you must also have strong computer skills and a solid understanding of accounting tax laws.

Start your own accounting business

These are the most important things to consider when starting an accounting firm. Although there are many benefits to starting your own business, it is important to do some research. You must be able to offer legal advice to your clients in order for you start a business legally. This is based on your education and certification. For example, only a CPA is allowed to file reports with SEC. This can make client finding difficult.

Entrepreneurship can allow you to combine your accounting skills along with your entrepreneurial spirit. Home-based businesses can offer you the opportunity to build a profitable business with your family's support. While you may have limited control over the strategic direction of your business, you'll also have the opportunity to focus on what you're best at. You can help your clients with your accounting skills, even if you have a small business.

FAQ

What is a Certified Public Accountant and how do they work?

A C.P.A. certified public accountant is a person who has been certified in public accounting. A certified public accountant (C.P.A.) is an individual with special knowledge in accounting. He/she is able to prepare tax returns and help businesses make sound business decisions.

He/She keeps an eye on the company's cash flow, and ensures that everything runs smoothly.

Why is reconciliation important?

It's very important because you never know when mistakes happen. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems could have severe consequences, such as incorrect financial statements, missed deadlines or overspending.

What is an auditor?

Auditors look for inconsistencies in financial statements and actual events.

He verifies the accuracy of all figures supplied by the company.

He also verifies that the company's financial statements are valid.

What is the difference between bookkeeping and accounting?

Accounting studies financial transactions. The recording of these transactions is called bookkeeping.

They are both related, but different activities.

Accounting deals primarily using numbers, while bookskeeping deals primarily dealing with people.

For reporting purposes on an organization's financial condition, bookkeepers keep financial records.

They make sure all of the books balance by adjusting entries in accounts payable, accounts receivable, payroll, etc.

Accountants analyze financial statements to determine whether they comply with generally accepted accounting principles (GAAP).

They might recommend changes to GAAP, if not.

Bookskeepers record financial transactions in order to allow accountants to analyze it.

What is the significance of bookkeeping and accounting

Bookkeeping and accounting are important for any business. They are essential for any business to keep track and monitor all transactions.

These items will also ensure that you don't spend too much on unnecessary items.

You need to know how much profit you've made from each sale. It's also necessary to know your responsibilities to others.

You may want to raise prices if there isn't enough money coming in. However, if your prices are too high, customers might not be happy.

You may be able to sell some inventory if you have more than what you need.

You can reduce the number of products or services you use if you have less money.

These things can have a negative impact on your bottom line.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to be an Accountant

Accounting is the science and art of recording financial transactions and analyzing them. It can also involve the preparation statements and reports for various purposes.

A Certified Public Accountant or CPA is someone who has passed an exam and received a license from the state board.

An Accredited Financial Advisor (AFA), is an individual that meets certain criteria established by American Association of Individual Investors. A minimum of five years' experience in investment is required by the AAII before an individual can become an AFA. They must pass a series exam to verify their understanding of accounting principles.

A Chartered Professional Accountant (CPA), sometimes referred to as a chartered accountant, is a professional accountant who has been awarded a degree from a recognized university. CPAs must adhere to the Institute of Chartered Accountants of England & Wales' (ICAEW), specific educational requirements.

A Certified Management Accountant (CMA), is a certified professional accountant that specializes in management accounting. CMAs must pass the ICAEW exams and continue their education throughout their careers.

A Certified General Accountant (CGA), member of the American Institute of Certified Public Accountants. CGAs are required take several exams. The Uniform Certification Examination is one of them.

International Society of Cost Estimators, (ISCES), offers the Certified Information Systems Auditor (CIA), a certification. Candidates for the CIA need to complete three levels in order to be eligible. These include practical training, coursework and a final examination.

Accredited Corporate Compliance Official (ACCO), a title granted by ACCO Foundation and International Organization of Securities Commissions. ACOs must possess a Bachelor's Degree in Finance, Business Administration, Economics, or Public Policy. They must pass two written exams, and one oral exam.

A Certified Fraud Examiner (CFE) is a credential by the National Association of State Boards of Accountancy (NASBA). Candidates must pass at least three exams to be certified fraud examiners (CFE).

A Certified Internal Auditor (CIA) is accredited by the International Federation of Accountants (IFAC). Candidates must pass four exams covering topics such as auditing, risk assessment, fraud prevention, ethics, and compliance.

American Academy of Forensic Sciences gives Associate in Forensic Accounting (AFE), a designation. AFEs must have graduated with a bachelor’s degree from an approved college or university in any other study area than accounting.

What is the job of an auditor? Auditors are professionals who conduct audits of organizations' internal controls over financial reporting. Audits can take place on an individual basis or on the basis of complaints received from regulators.