There are several steps involved in obtaining a CPA License in the District of Columbia. The first step is to take the Uniform CPA Exam. Once you have passed the exam, you will need additional requirements to get your license.

A bachelor's degree from an accredited college is required for DC CPA licensure. Your college transcript must be approved by the DC Board of Accountancy before you count it towards the 120 credit hours required for a CPA license.

Next, you will need to meet the work experience requirement. You will need to have at least one-year of experience in public or not-public accounting. CPAs are required to verify that you have work experience. You can work part-time or fully-time. The experience must be completed within a year. The DC Board of Accountancy doesn't require you to take an ethics exam. However, it is possible to choose to take an Ethics Course.

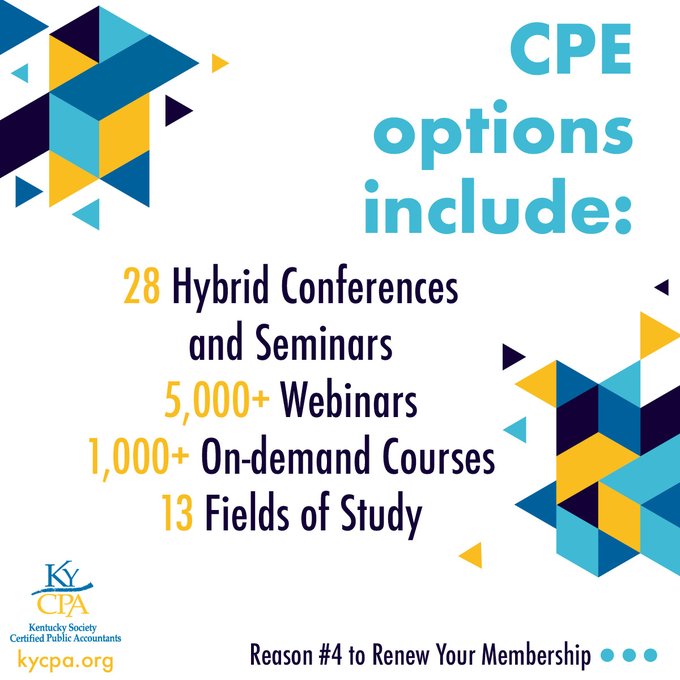

CPE classes may also be an option. CPE is an essential part of many professional careers. You can earn up 50% of your CPE through formal instruction. You must complete at least 40 hours annually of approved continuing education courses if you plan to take CPE classes. Your location may have different CPE classes. Additionally, you will need to take four hours of professional ethical instruction every licensing cycle.

Along with your application fee, transcripts, government-issued ID and a two-X-2 photograph, you must also submit a license application. It may also be necessary to show proof of your work experience. On the District of Columbia Board of Accountancy's site, you can find additional information.

For DC CPAs, you must also meet the educational and age requirements. To become a DC CPA, applicants must be at least 18 years old. An accredited college must grant you a Bachelor’s degree and you must have completed at most 120 college credits. You will also need to take 12 hours of business-related classes.

After becoming a DC CPA you must renew your license every two years. The renewal period runs from January through December each year. CPE does not need to be completed for any license issued in the last two years. CPE is required for DC CPAs that have been licensed for less than two years. You must still complete 80 hours every two years.

Along with the requirements above, you'll need to pay a CPA exam fee. CPA exam fee in DC is $743. Prometric administers the CPA exam in DC. They have testing centers in Washington DC and Falls Church, Virginia. Online CPA testing is also possible, saving you time and money. Online classes offer the same convenience as traditional classrooms, but with the same camaraderie.

You will need to complete the requirements for work experience after passing the CPA exam. Minimum 2,000 hours of work experience will be required. This experience can either be part-time and full-time. It must be completed within one calendar year after obtaining your license. While you may be able to work as a CPA or in the government, your experience must be documented.

FAQ

What is the value of accounting and bookkeeping

For any business, bookkeeping and accounting are crucial. They are essential for any business to keep track and monitor all transactions.

They can also help you avoid spending too much on unnecessary things.

You should know how much profit your sales have brought in. Also, you will need to know how much debt you owe other people.

You might consider raising your prices if you don't have the money to pay for them. You might lose customers if you raise prices too much.

You might consider selling off inventory that is larger than you actually need.

You can reduce the number of products or services you use if you have less money.

All of these factors will impact your bottom line.

What does an auditor do exactly?

Auditors look for inconsistencies between financial statements and actual events.

He confirms the accuracy and completeness of the information provided by the company.

He also verifies that the company's financial statements are valid.

What exactly is bookkeeping?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. It also includes the recording of all business-related income and expenses.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They also prepare tax reports and other reports.

What is an accountant's role and why does it matter?

An accountant keeps track on all the money you make and spend. They track how much you pay in taxes and what deductions you are allowed to make.

An accountant helps manage your finances by keeping track of your income and expenses.

They can prepare financial reports both for individuals and companies.

Accounting professionals are required because they need to be able to understand all aspects of the numbers.

Additionally, accountants assist with tax filing and make sure that taxpayers pay the least amount of tax.

Statistics

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to Get a Degree in Accounting

Accounting is the process of keeping track of financial transactions. It records transactions made by individuals, governments, and businesses. The term "account" means bookkeeping records. These data help accountants create reports to aid companies and organizations in making decisions.

There are two types of accountancy - general (or corporate) accounting and managerial accounting. General accounting is concerned with the measurement and reporting of business performance. Management accounting is about measuring, analyzing and managing resources within organizations.

A bachelor's degree in accounting prepares students to work as entry-level accountants. Graduates might also be able to choose to specialize, such as in auditing, taxation, finance or management.

Accounting is a career that requires a solid understanding of economic concepts like supply and demand and cost-benefit analysis. Marginal utility theory, consumer behavior, price elasticity of demand and law of one price are all important. They should also be able to understand macroeconomics, microeconomics and accounting principles as well as various accounting software packages.

A Master's degree in Accounting requires that students have successfully completed six semesters worth of college courses. These include Microeconomic Theory, Macroeconomic Theory. International Trade. Business Economics. Financial Management. Auditing Principles & Procedures. Accounting Information Systems. Cost Analysis. Taxation. Human Resource Management. Finance & Banking. Statistics. Mathematics. Computer Applications. English Language Skills. Graduate Level Examinations must also be passed. This exam is typically taken at the end of three years' worth of study.

Candidates must complete four years in undergraduate and four years in postgraduate studies to become certified public accountants. Before they can apply for registration, candidates will need to take additional exams.