Are you looking to hire a virtual accountant? This article will explain the benefits of virtual bookkeeping, the costs involved, and how to get started. This article should help you to find the right candidate. Then, you can begin working with a virtual bookkeeper immediately. And, in the meantime, get a feel for the job by reading on!

Job duties of a virtual bookkeeper

As a virtual bookkeeper, there are many ways you can advertise your services. Advertising in bookkeeping forums is a good way to get word out. Ask for recommendations from people you know and use social selling to market your services. A website must be maintained and updated to provide value to clients. By branding yourself well, you can attract more clients. Here are some tips to help you get more clients.

Virtual bookkeeping offers a cost-effective way to manage your business. Virtual bookkeeping services are cheaper than hiring a fulltime bookkeeper. The best part about hiring a virtual bookkeeper? You'll get objective insight into your company's financial health. This is critical for making sound business decisions.

Cost of hiring a virtual bookkeeper

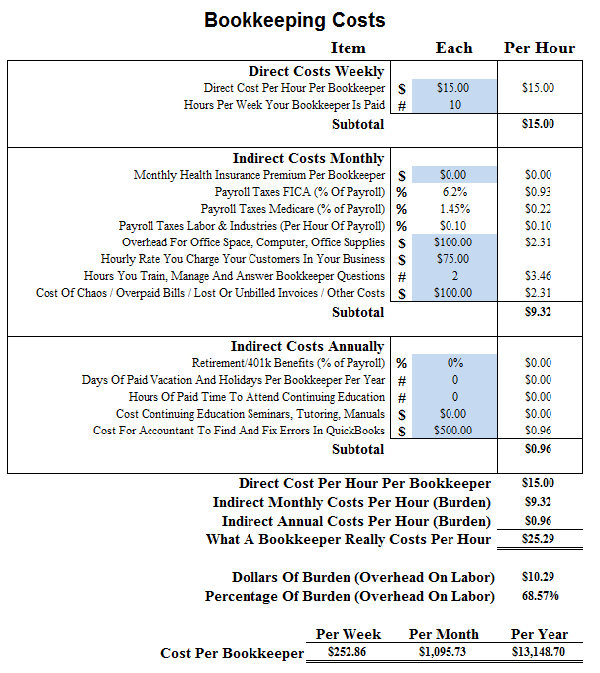

In addition to the benefits mentioned above, hiring a virtual bookkeeper can save you money on payroll taxes and overhead. California employers are responsible to pay Social Security and Medicare taxes as well as Employment Training Tax, and California Unemployment Tax. To learn more about these taxes, visit the California Tax website. The cost of hiring a virtual bookkeeper is as low as $50 per Month, and as high as $3,000/month depending on the volume.

Virtual bookkeepers work remotely and are much less expensive than hiring local bookkeepers. Another benefit of using a virtual bookkeeper to manage your accounting needs is the lower cost. They will only charge you for the time that they are required. Hourly rates and fixed fees can be paid for virtual bookkeepers.

Online training to be a virtual bookkeeper

Online bookkeeping courses are a good way to get started in the virtual world of bookkeeping. These courses often include step-by, interactive quizzes, and other resources that help you get to know more about the business. You can even gain access to an exclusive online community of bookkeepers that will help you gain more clients and gain experience. You can learn more about virtual bookkeeping by taking an online course.

You must learn the skills necessary to become a virtual accountant. You can make $60 an hour working for private clients once you have developed your skills. Watch videos to learn more about your business during the online course. Kirsty worked as a Business Manager for a while before she decided that she wanted to be a virtual bookkeeper. Now she has 11 clients and generates more than $3,000 per monthly.

Online platforms that allow you to freelance for virtual bookkeepers

Freelancing platforms for virtual bookkeepers allow you to post your resume and get matched with clients. These platforms are full of tools and resources that can help you find work. Here are some top websites to search for remote bookkeeper positions. They can help you get a part time job while earning more.

Most freelancers charge by the hour, which is why the more transactions you have each month, the more you'll pay for the service. You should be prepared to disclose your hourly rate and other details, such as your experience and skills and the number transactions per month, when looking for a virtual Bookkeeper. While some freelancers work only with cash-basis accounting, others use accrual. If you're not sure which type of accounting system is best for your business, hire a virtual service, which usually has a team of bookkeepers and more robust features.

FAQ

What happens if I don't reconcile my bank statement?

You may not realize you made a mistake until the end of the month if you don't reconcile your bank statements.

At this point, you will need repeat the entire process.

What should I do when hiring an accountant?

When hiring an accountant, ask questions about their experience, qualifications, and references.

You want someone who has done this before and knows what he/she is doing.

Ask them about any skills or knowledge they may have that could be of assistance to you.

Look for people who are trustworthy in your community.

What are the types of bookkeeping software?

There are three main types: hybrid, computerized, and manual bookkeeping systems.

Manual bookkeeping uses pen and paper to keep track of records. This method requires constant attention.

Software programs are used for computerized bookkeeping to manage finances. It's easy to use and saves you time.

Hybrid bookkeeping combines both manual and computerized methods.

What are the salaries of accountants?

Yes, accountants can be paid hourly.

Accounting firms may charge an additional fee to prepare complex financial statements.

Sometimes accountants may be hired to perform specific tasks. A public relations agency might hire an accountant to prepare reports showing the client's progress.

Statistics

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

External Links

How To

How to do bookkeeping

There are many types of accounting software available today. There are many types of accounting software available today. Some are free while others cost money. However, they all offer basic features like invoicing and billing, inventory management as well as payroll processing, point of sale systems and financial reporting. The following list provides a brief description of some of the most common types of accounting packages.

Free Accounting Software: Most accounting software is free and available for personal use. Although the software may be limited in functionality, such as not being able to create your own reports, it is very easy to use. Many programs are free and allow you to save data to Excel spreadsheets. This is useful if you need to analyze your own business numbers.

Paid Accounting Software is for businesses with multiple employees. These accounts are powerful and can be used to track sales and expenses and generate reports. Many companies offer subscriptions with a shorter duration than six months, but most paid programs require a minimum subscription of at least one year.

Cloud Accounting Software. Cloud accounting software allows for remote access to your files using any mobile device such as smartphones and tablets. This program has been growing in popularity because it reduces clutter and saves space on your computer's hard drive. You don't even have to install any extra software. All you need is a reliable Internet connection and a device capable of accessing cloud storage services.

Desktop Accounting Software: Desktop software works in a similar way to cloud accounting software. However, it runs locally on your own computer. Desktop software works in the same way as cloud software. It allows you to access files from any location, including via mobile devices. However, unlike cloud, you have to install it on your computer before using it.

Mobile Accounting Software: This mobile accounting software was specifically developed to work on tablets and smartphones. These apps allow you to manage your finances on the move. They offer fewer functions than desktop programs, but are still useful for those who travel a lot or run errands.

Online Accounting Software - Online accounting software was created primarily to serve small businesses. It has all the features of a traditional desktop software package, but with a few additional bells and whistles. The best thing about online software is the fact that it does not require installation. You simply log in to the site to start the program. Another benefit is that you'll save money by avoiding the costs associated with a local office.