You should approach companies directly if you're looking for proofreading work. Employers may hire workers or freelancers. Legitimate employers won't charge any application fees. Most employers will require applicants complete a preliminary test. This is usually a 20-question screening questionnaire that evaluates applicants' proofreading abilities and determines whether they should apply for further steps. Avoid companies that demand payment to proofread your application.

Skills required

A variety of skills are needed to become proofreader. It's crucial that you have them all. These skills can be broken down into soft skills like interpersonal communication, problem-solving, writing, editing, and writing skills. On the other hand, hard skills are those that can be learned, such as database management, computer programming, and specialized software. The following are a few examples of skills that are required in a proofreading company.

Consider signing up for the upwork and freelancing websites if you always wanted to work in proofreading. These sites allow proofreading work to be applied for and you can bid on jobs on these sites. Another option is SmartBrief, a digital media publisher focused on business news, which pays $15 per hour for proofreading work. Polished paper, which requires a 35-question exam and pays proofreaders with more experience, is another option.

Hours of hard work

Looking for proofreading jobs via a freelance platform? If you're looking to work remotely and make your own hours, a freelance website might be the right place for you. Scribendi has many proofreading and editing jobs. Members can also interact on a forum. To apply online, you will need to upload your resume and complete a confidentiality agreement. Once you've applied, you'll need to wait to be approved.

Although freelance proofreading jobs can be as challenging as full-time editorial work they are much more affordable. Although you'll need a computer to proofread, a tablet is usually sufficient. It is also necessary to be able work with text files. Sites like MediaBistro also offer proofreading jobs. MediaBistro offers more freelance opportunities than any other proofreading company.

Rates

Rates for proofreading service are affected by many factors. Ideal rates will be determined by the market rate. This rate can usually be set by an established editing association. Rates will vary depending upon the type of document or the difficulty of the task. Listed below are median rates for proofreading services offered by some popular online platforms. Here are some examples for proofreading rates by industry. Check out your competition's services as well as the rates above.

Although freelancers tend to charge less, there are some things you need to keep in mind when selecting a proofreading company. You should check for testimonials and professionalism on the website. You should also check if the freelancers can speak English fluently. The proofreader should be a native speaker of English. Reliable proofreading companies will offer a guarantee because it is essential that clients are satisfied with their final product.

FAQ

What's the purpose of accounting?

Accounting is a way to see a financial picture by recording, analyzing and reporting transactions between people. It allows organizations to make informed financial decisions, such as whether to invest more money, how much income they will earn, and whether to raise additional capital.

Accountants record transactions in order to provide information about financial activities.

The company can then plan its future business strategy, and budget using the data it collects.

It is essential that data be accurate and reliable.

What is a Certified Public Accountant (CPA)?

A C.P.A. certified public accountant is a person who has been certified in public accounting. An accountant with specialized knowledge is one who has been certified as a public accountant (C.P.A.). He/she is able to prepare tax returns and help businesses make sound business decisions.

He/She also tracks cash flow and makes sure that the company runs smoothly.

What is an auditor?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He verifies the accuracy of all figures supplied by the company.

He also validates the validity and reliability of the company's financial statements.

What does it really mean to reconcile your accounts?

The process of reconciliation involves comparing two sets. One set of numbers is called the source, and the other is called reconciled.

The source consists of actual figures, while the reconciled represents the figure that should be used.

For example, if someone owes you $100, but you only receive $50, you would reconcile this by subtracting $50 from $100.

This process ensures that there aren't any errors in the accounting system.

What is the difference between a CPA and a Chartered Accountant?

Chartered accountants are professionals who have successfully passed the examinations required to be designated. Chartered accountants have more experience than CPAs.

Chartered accountants are also qualified in tax matters.

A chartered accountancy course takes 6-7 years to complete.

Accounting is useful for small business owners.

Accounting is not only for large businesses. Accounting can also be useful for small businesses because it allows them to track how much money they spend and make.

You probably know how much money your business is making each month if you are a small-business owner. But what if your accountant doesn't do this for a monthly basis? You might find yourself wondering where you are spending your money. It is possible to forget to pay your bills on a timely basis, which can negatively affect your credit rating.

Accounting software makes it simple to track your finances. There are many types of accounting software. Some are free while others cost hundreds to thousands of dollars.

No matter what type of accounting system, it is important to first understand the basics. This way, you won't waste time learning how to use it.

You should learn how to do these three basics tasks:

-

Record transactions in the accounting system.

-

Track your income and expenses.

-

Prepare reports.

These three steps will help you get started with your new accounting system.

Statistics

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

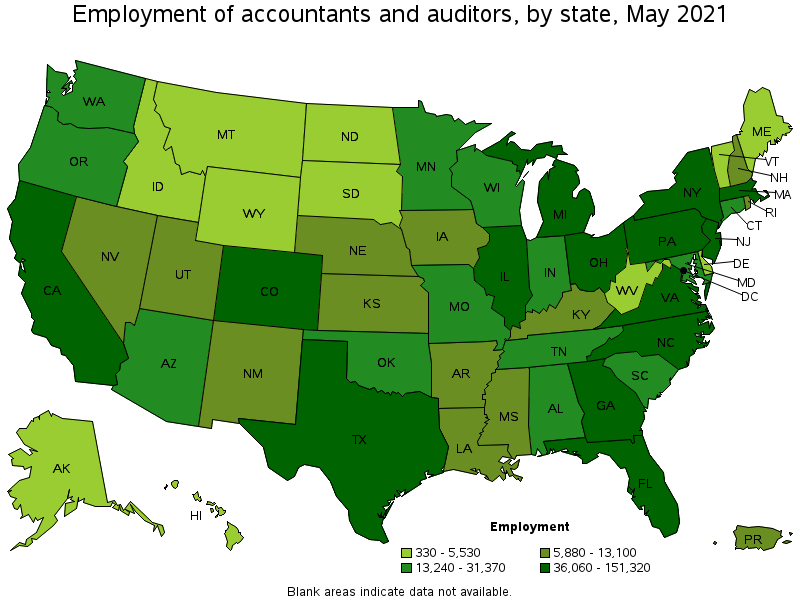

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to do bookkeeping

There are many options for accounting software today. There are many types of accounting software available today. Some are free while others cost money. However, they all offer basic features like invoicing and billing, inventory management as well as payroll processing, point of sale systems and financial reporting. Here is a list of the most commonly used accounting packages.

Free Accounting Software: This accounting software is generally free and can be used only for personal purposes. Although the program is limited in functionality (e.g. it cannot be used to create your reports), it can often be very easy for anyone to use. Many free programs also allow you to download data directly into spreadsheets, making them useful if you want to analyze your business's numbers yourself.

Paid Accounting Software: Paid accounts are designed for businesses with multiple employees. These accounts offer powerful tools for managing employee records as well as tracking sales and expense, creating reports, and automating processes. The majority of paid programs require a minimum one-year subscription fee. However, some companies offer subscriptions that are less than six months.

Cloud Accounting Software: Cloud accounting software allows you to access your files anywhere online, using mobile devices such as smartphones and tablets. This program has gained popularity due to the fact that it frees up space on your hard drive, reduces clutter, is easier to use remotely, and also makes work more efficient. It doesn't require you to install additional software. All you need is a reliable Internet connection and a device capable of accessing cloud storage services.

Desktop Accounting Software is a version of cloud accounting software that runs on your local computer. Desktop software allows you to access your files anywhere, even via mobile devices, just like cloud software. However, unlike cloud, you have to install it on your computer before using it.

Mobile Accounting Software is designed to run on smaller devices, such as tablets and smartphones. These programs let you manage your finances while on the go. They have fewer functions that full-fledged desktop apps, but they're still extremely useful for people who travel often or run errands.

Online Accounting Software - Online accounting software was created primarily to serve small businesses. It provides all of the same features as a traditional desktop program but adds a few extras. Online software doesn't need to be installed. All you have to do is log on and get started using it. Another advantage is the fact that you will save money because you won't have to go to a local office.