There are many career options available for those looking for work in accounting. You have the choice of bookkeeping, accounts payable specialist, collections clerk, staff accountant, or staff accountant. You need to have traditional skills, but also the right personality traits. These traits will be more important than your actual skills. Here are some ways to secure an accounting job. You should have the right personality traits to get a job as an accountant.

Bookkeeping

If you are good with numbers and have a keen attention to detail, bookkeeping could be an excellent career choice. In fact, many aspiring accountants begin their career as bookkeepers. The best accountants are those who excel in their work. This job requires high oversight. Bookkeepers need to be skilled in the details so they don't make mistakes. Bookkeepers can work for different clients or independently.

Bookkeepers can have many job titles, but they all record financial transactions. They can document everything, including vendor invoices and sales receipts. To make informed financial decisions, businesses use their records. Bookkeepers can also create profit and loss reports that are often reviewed and approved by budget analysts and managers. A bookkeeper's job description should be as detailed as possible, and be specific to the type of organization the employer works for.

Specialist in accounts payable

The Accounts Payable Specialist handles all accounts payable. This includes expense reporting, sales taxes, and invoice submissions. This position is essentially an accounting clerk whose job is to make sure payments are timely and accurately. An Associate's degree in finance or accounting is required, along with a few years work experience. Although the job is technically demanding, the ideal candidate should have previous experience in similar fields.

A Accounts Payable Specialist is expected to work in a office setting and interface between various employees of the company, including senior managers and vendors. They can also be the first point to contact vendors. All accounting work is completed in accordance with company procedures. The Accounts Payment Specialist will typically be responsible to oversee all aspects of the accounting process. They will also code every item in accordance to company standards. This job may not be for everyone.

Collections clerk

The role of collections clerk in an accounting firm entails contacting overdue customers to ensure that they pay their accounts in full. They will enter the payment amounts into the accounting records. If necessary, they may take legal action. In addition to their administrative duties, collection clerks must have outstanding communication skills, negotiation skills, and an in-depth knowledge of debt collection laws. Collections clerks have the following duties: ensuring timely payments of outstanding accounts; following up with overdue account status and drafting reports.

The average salary for collections/Accounts Receivable jobs is between $33,500 to $61,500. There are many opportunities for employment in the nation. ZipRecruiter lists approximately 4,000 jobs hiring now. Start your search for this job today if you're interested. To see all the options available, just type collections clerk into your search box. You'll find thousands of job openings nationwide. These are just some benefits of being a collections assistant in an accounting company.

Personal accountant

If you are searching for a staff accounting position, ensure the job description has a call to actions. A call to action is a section of a job posting that attempts to turn job seekers into candidates. It could contain a link that allows candidates to apply or an address at which they can send their resumes. You are now one step closer to hiring your next employee. Look online for the job description and find your next staff accountant position.

A bachelor's degree in accounting, business finance or another related field is required. Many companies offer internships for entry-level students. Successful interns may even be offered permanent employment before graduating. An MBA in accounting can improve your career prospects as a staff accountant at a startup because their HR departments place a higher emphasis on emotional intelligence than on technical skills. A staff accountant in a startup company may not have a large accounting or finance department. Therefore, they must have strong communication skills and analytical skills.

FAQ

How do accountants work?

Accountants work with clients to ensure they make the most out of their money.

They are closely connected to professionals such as bankers, lawyers, auditors, appraisers, and auditors.

They also work with internal departments like human resources, marketing, and sales.

Accounting professionals are responsible for maintaining balance in the books.

They determine the tax due and collect it.

They also prepare financial reports that reflect how the company is doing financially.

What is a Certified Public Accountant, and what does it mean?

A C.P.A. is a certified public accountant. An accountant is someone who has special knowledge in accounting. He/she can prepare tax returns for businesses and assist them in making sound business decisions.

He/She also tracks cash flow and makes sure that the company runs smoothly.

What is an Audit?

Audits are a review of financial statements. An auditor examines the company's accounts to ensure that everything is correct.

Auditors are looking for discrepancies among what was reported and actually occurred.

They also verify that the financial statements of the company are correct.

What are the differences between different bookkeeping systems?

There are three main types in bookkeeping: computerized (manual), hybrid (computerized) and hybrid.

Manual bookkeeping is the use of pen and paper to keep records. This method requires constant attention.

Computerized bookkeeping is a way to keep track of finances using software programs. This saves time, effort, and money.

Hybrid bookkeeping is a combination of both computerized and manual methods.

What should I look for in an accountant's hiring decision?

When hiring an accountant, ask questions about their experience, qualifications, and references.

You need someone who is experienced in this type of work and can explain the steps.

Ask them about any skills or knowledge they may have that could be of assistance to you.

Be sure to establish a good reputation within the community.

What happens if my bank statement isn't reconciled?

You might not realize that you made a mistake in reconciling your bank statements until the end.

At that point, you'll have to go through the entire process again.

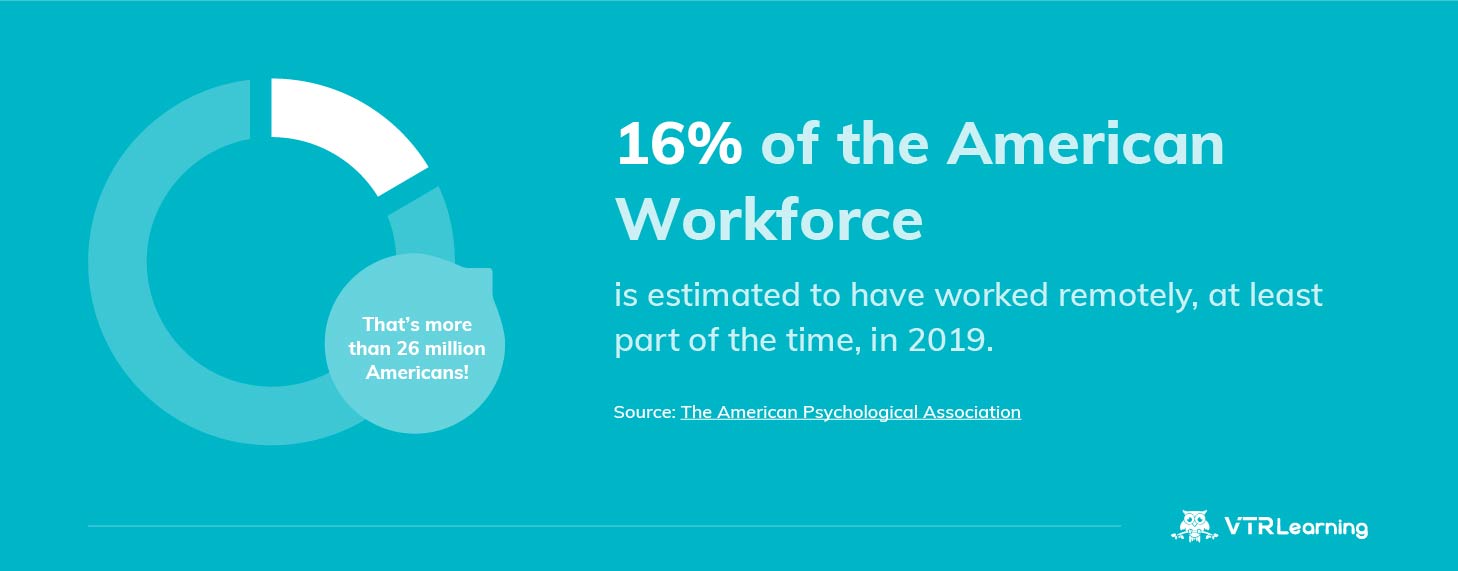

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

How to become an accountant

Accounting is the science and art of recording financial transactions and analyzing them. It also involves the preparation of reports and statements for various purposes.

A Certified Public Accountant is someone who has passed and been licensed by the state board.

An Accredited financial analyst (AFA), or an individual who meets the requirements of the American Association of Individual Investors, is an individual who is accredited by Financial Analysts. A minimum five-year investment history is required in order to be an AFA according to the AAII. They must pass a series exam to verify their understanding of accounting principles.

A Chartered Professional Accountant is also known by the name chartered accountant. This is a professional accountant who received a degree at a recognized university. The Institute of Chartered Accountants of England & Wales (ICAEW) has established specific educational standards for CPAs.

A Certified Management Accountant or CMA is a professionally certified accountant who specializes only in management accounting. CMAs have to pass exams administered by ICAEW and keep up-to-date with continuing education requirements throughout the course of their careers.

A Certified General Accountant (CGA), member of the American Institute of Certified Public Accountants. CGAs are required to take several tests; one of these tests is known as the Uniform Certification Examination (UCE).

The International Society of Cost Estimators offers the certification of Certified Information Systems Auditor (CIA). Candidates for the CIA must have completed three levels of education: coursework, practical training, then a final exam.

The Accredited Corporate Compliance Officer (ACCO), is a designation that has been granted by the ACCO Foundation (IOSCO). ACOs need to have a bachelor's degree in finance, public policy, or business administration. They must also pass two written exams as well as one oral exam.

The National Association of State Boards of Accountancy's Certified Fraud Examiner credential (CFE), is awarded by NASBA. Candidates must pass three exams, and get a minimum score 70%.

The International Federation of Accountants (IFAC) has accredited a Certified Internal Auditor (CIA). Four exams must be passed by candidates to receive certification as an Internal Auditor (CIA). They will need to pass topics like auditing, compliance, risk assessment and fraud prevention.

An Associate in Forensic Accounting (AFE) is a designation given by the American Academy of Forensic Sciences (AAFS). AFEs need to have graduated from an accredited college/university with a bachelor's level in any other field than accounting.

What does an auditor do? Auditors are professionals who inspect financial reporting controls and audit the internal controls. Audits can either be done randomly or based on complaints about financial statements received by regulators.