Are you looking for information on how to become an accounting professional in Texas? This article will cover what it takes in Texas to become an accountant, how much education you need and what the job outlook for Texas accountants is. This will help you get started on your path to becoming a Certified Public Accountant. You should remember that this career path will not be easy without hard work.

A bachelor's degree is required

To become a Texas certified public accounting professional, you will need to earn a Bachelor's in Accounting from an accredited college. This degree can be used to study business law, taxation, finance, and economics. You will also find courses in statistics, marketing, and business law. You might consider working as an accountant or bookkeeper before you begin your studies. These positions can give you valuable experience and help you prepare for your CPA exam. If you're interested in becoming a CPA, you can also pursue a graduate program.

In Texas, there are many colleges and universities offering accounting degree programs. These programs can teach you both the basics of corporate and public accounting, as well as more specialized topics such as forensic accounting technology. Online degrees are also possible if you prefer to take your classes at your own time.

Experience in the workplace is required

To be able to work in Texas' diverse business sectors, a Texas CPA licensing is a good way to start. This license opens up many job opportunities in Texas, including high-tech startups in the Dallas area, small business and personal accounting with traditional CPA firms, and forensic accounting. An accountant can also work for government agencies or as a consultant. No matter which career path you choose, an accounting degree is highly valued by employers.

Texas has a relatively easy process for obtaining a CPA license. You will need a bachelor's degree and to pass the CPA exam. A course on ethics must be completed by the AICPA. This counts towards your CPE requirement. After passing the exam you must complete 150 hours of education. Afterward, you'll need to gain 2,000 hours of work experience in a supervised environment and have the experience verified by a CPA. This experience should be gained within three years after passing your exam.

Texas accountants have a bright future

Texas has a favorable job outlook in accounting. Texas' economy is heavily dependent on international trade. This means that accountants who are fluent in multiple languages will be an asset to this industry. Some of the largest companies in Texas include Marathon Oil and URS Corporation. Tesoro Corporation and ALS Environmental are other notable companies based in Texas. These firms require accountants who are familiar with environmental regulations.

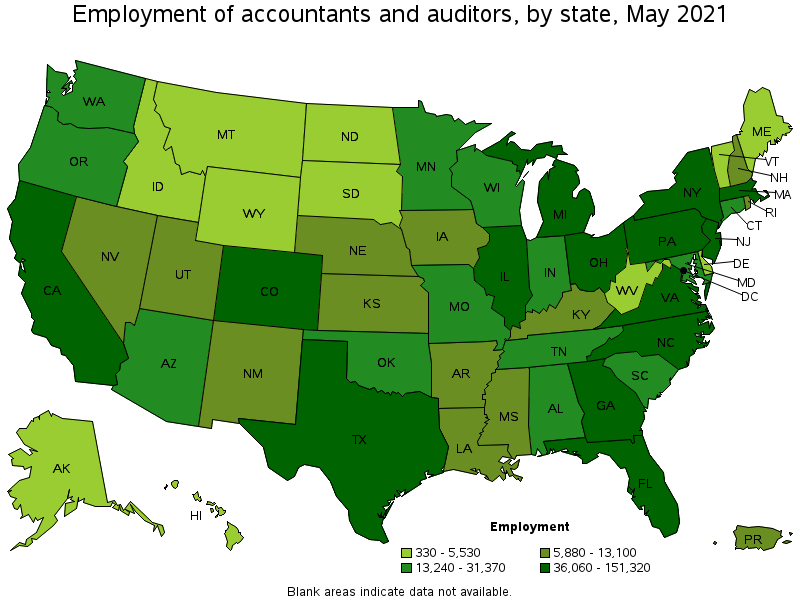

Texas is in high demand for auditors and accountants. The Texas Workforce Commission predicts a 18.8% increase of employment in Texas for accountants between 2018-2028. As a result, Texas is projected to have 15,480 openings for accounting professionals in that time. Texas accountants had a median income of $73,420 in May 2020.

FAQ

What's the difference between a CPA or Chartered Accountant?

A chartered accountant is a professional accountant who has passed the exams required to obtain the designation. Chartered accountants have more experience than CPAs.

Chartered accountants can also offer advice on tax matters.

The average time to complete a chartered accountancy program is 6-8 years.

What's the difference between accounting & bookkeeping?

Accounting is the study of financial transactions. These transactions are recorded in bookkeeping.

These two activities are closely related, but distinct.

Accounting is primarily about numbers while bookkeeping is primarily about people.

For the purpose of reporting on financial conditions of organizations, bookkeepers maintain financial information.

They adjust entries in accounts payable, receivable, and payroll to ensure that all books are balanced.

Accountants review financial statements to determine compliance with generally accepted Accounting Principles (GAAP).

They may suggest changes to GAAP if they do not agree.

For accountants to be able to analyze the data, bookkeepers must keep track of financial transactions.

Accounting Is Useful for Small Business Owners

Accounting isn't just for big companies. Accounting can also be useful for small businesses because it allows them to track how much money they spend and make.

If you run a small business, you likely know how much money comes in each month. What happens if an accountant isn't available to you? You might be wondering about your spending habits. You might forget to pay your bills on time which could negatively impact your credit rating.

Accounting software makes it easy for you to keep track and manage your finances. There are many kinds of accounting software. Some are completely free, while others can cost hundreds of thousands of dollars.

However, regardless of the type of accounting software you choose, you will need to be familiar with its basics. You won't have to spend time learning how it works.

These are the three most important tasks you should know:

-

Enter transactions into the accounting system.

-

Keep track of your income and expenses.

-

Prepare reports.

These are the three essential steps to get your new accounting system up and running.

How does an accountant do their job?

Accountants partner with clients to help them get the most out their money.

They work closely alongside professionals like bankers, attorneys, auditors and appraisers.

They also assist internal departments such as human resources, marketing, sales, and customer service.

Accounting professionals are responsible for maintaining balance in the books.

They determine the tax due and collect it.

They prepare financial statements that show the company's financial performance.

What does an accountant do? Why is it so important to know what they do?

An accountant keeps track and records all the money you spend and earn. They also record how much tax you pay and what deductions are allowable.

Accounting helps you manage your finances by keeping track your income and expenses.

They help prepare financial reports for businesses and individuals.

Accounting is a necessity because accountants must know all about numbers.

Additionally, accountants assist with tax filing and make sure that taxpayers pay the least amount of tax.

What does an auditor do?

Auditors look for inconsistencies between financial statements and actual events.

He validates the accuracy of figures provided by companies.

He also verifies that the company's financial statements are valid.

What is the best way to keep books?

A few items are necessary to start keeping books. These items include a notebook and pencils, calculator, staplers, envelopes, stamps and a filing drawer or desk drawer.

Statistics

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

Accounting: The Best Way

Accounting refers to a series of processes and procedures that enable businesses to accurately track and record transactions. Accounting involves recording income and expense, keeping track sales revenue and expenditures and preparing financial statements.

It involves reporting financial results on behalf of stakeholders, such as shareholders and lenders, investors, customers, or other parties.

Accounting can be done many different ways. Some of these are:

-

Create spreadsheets manually

-

Excel is a good choice.

-

Handwriting notes on paper.

-

Use computerized accounting systems.

-

Using online accounting services.

There are many ways to do accounting. Each method has its advantages and disadvantages. Which one you choose will depend on your business model, needs and preferences. Before you make a decision, be sure to consider the pros as well as the cons.

In addition to being efficient, there are other reasons you may decide to use accounting methods. Good books can prove your work if you are self-employed. Simple accounting techniques may work best for small businesses, especially if they don't have much money. If your business is large and generates large amounts cash, it might be a good idea to use more complex accounting methods.